Native Loans & Benefits

Native Loans & Benefits

Native American

Loan Information

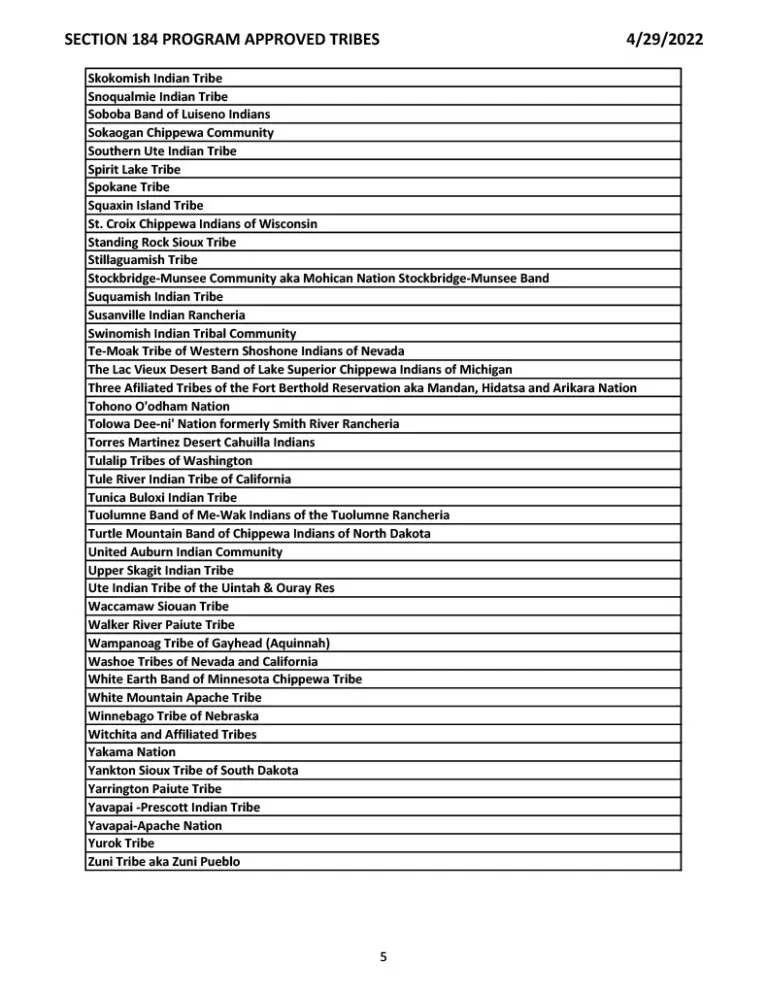

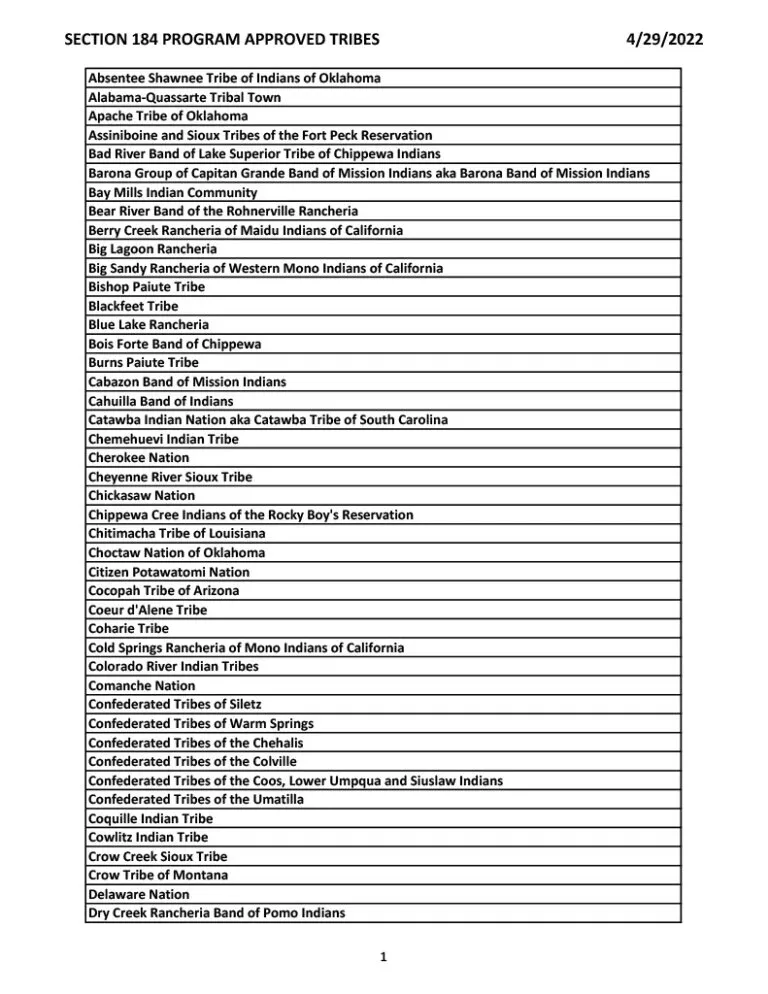

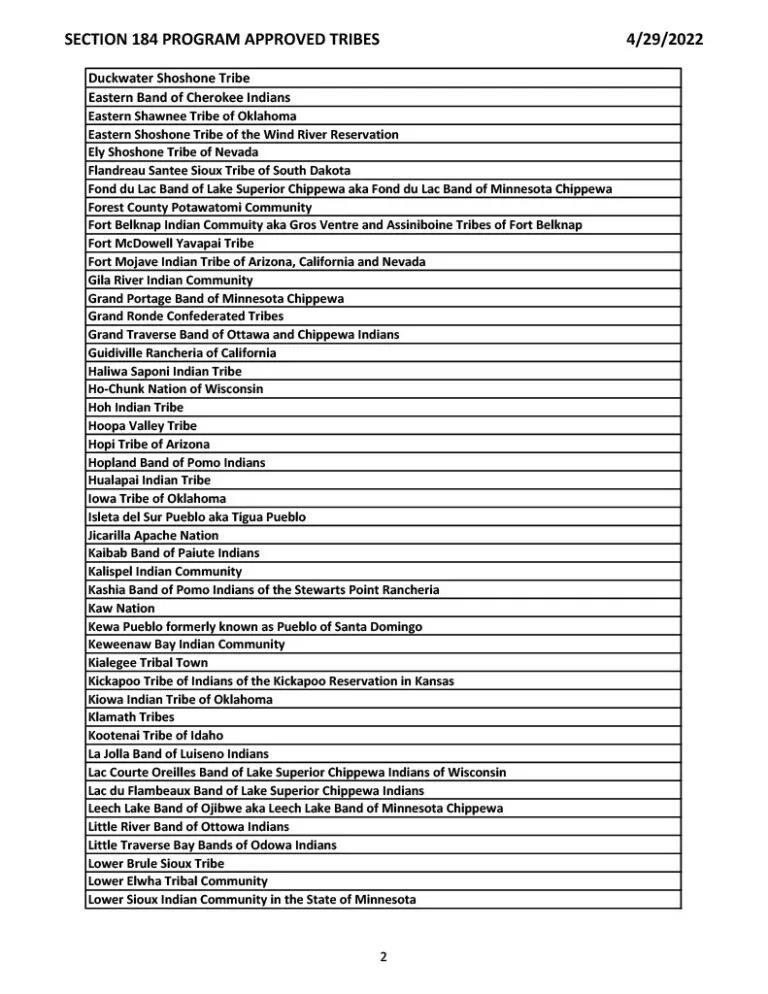

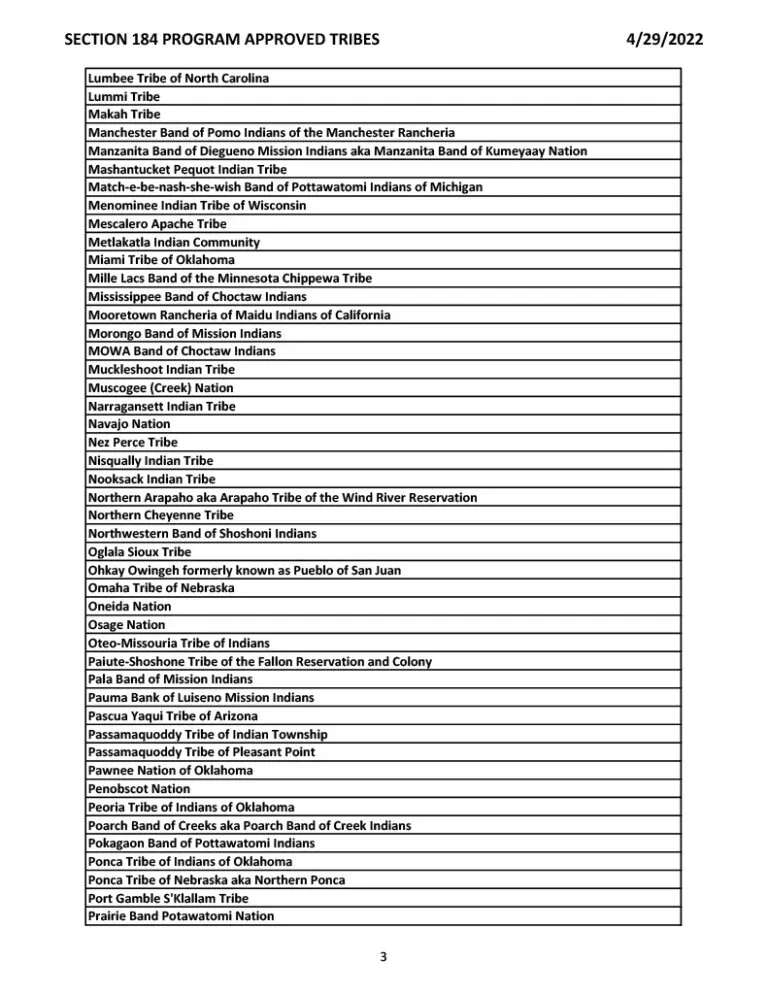

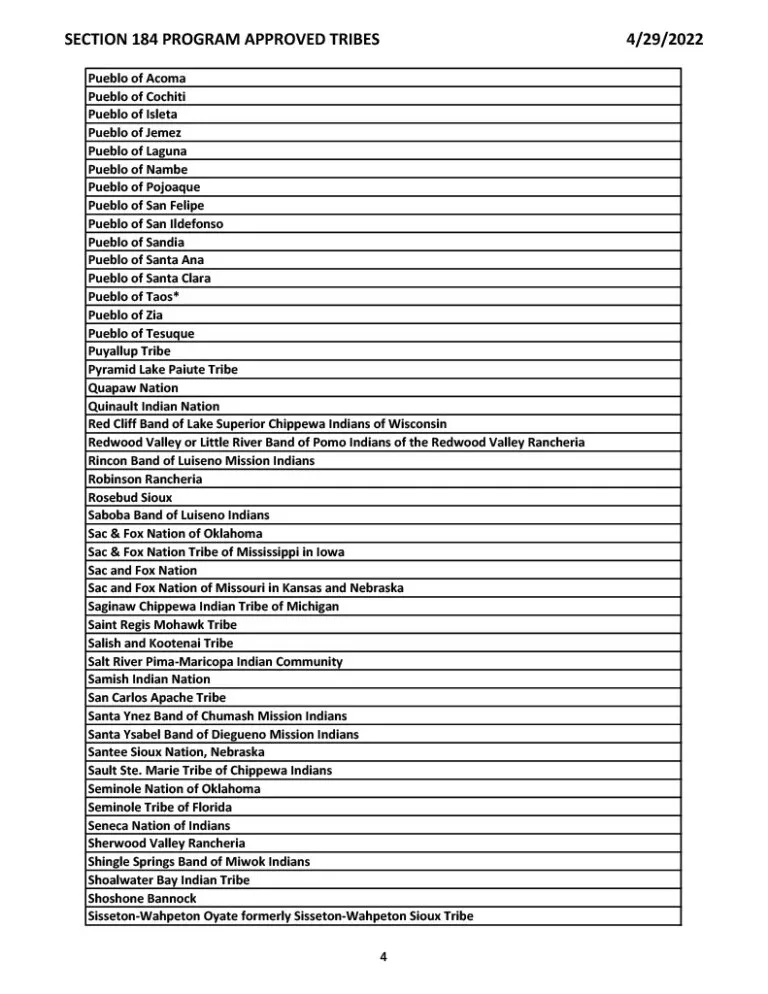

If you are a member of a federally recognized tribe with both a tribal membership card and a CDIB card, you may be eligible for an FHA 184 loan or Native American Loan. Like all federally funded loan programs, these loans have minimum income requirements, and eligibility is determined by various factors. Since each person's financial situation is unique, we won’t go into those specifics here. However, the primary advantage is a lower down payment compared to a standard FHA loan product. All of the lenders we recommend offer FHA 184 loan options. Please note that there is a period of unavailability during the 3rd and 4th quarters of the year when the federal program is re-approved for the upcoming year, typically between late September and October. Unsure if your tribe is federally recognized? We've included a list below for your review.

Why Consider the

Section 184 Loan?

The Section 184 Loan offers several benefits:

Low Down Payment: Just 2.25% for loans over $50,000 and 1.25% for loans under $50,000.

Competitive Interest Rates: Rates are based on current market levels, not on the applicant's credit score.

Personalized Underwriting: This program uses a manual, hands-on approach to assess applications, rather than relying on automated systems.

Upfront Guarantee Fee and Mortgage Insurance: A one-time 1.5% upfront guarantee fee is required at closing, which can be included in the loan. For loans with a loan-to-value ratio of 78% or more, there’s also an annual 0.25% mortgage insurance premium, payable monthly.

Protection from Predatory Lending: The program oversees fees charged by approved lenders to protect Native borrowers. Note: Section 184 loans are not available for Adjustable-Rate Mortgages (ARMs).

What Can the Section 184 Loan Be Used For?

The Section 184 Loan can be used to:

Buy a New or Existing Home.

Refinance an Existing Loan (for rate and term adjustments, streamlining, or cash-out refinancing).

Native American Loan Information

If you are a member of a federally recognized tribe with both a tribal membership card and a CDIB card, you may be eligible for an FHA 184 loan or Native American Loan. Like all federally funded loan programs, these loans have minimum income requirements, and eligibility is determined by various factors. Since each person's financial situation is unique, we won’t go into those specifics here. However, the primary advantage is a lower down payment compared to a standard FHA loan product. All of the lenders we recommend offer FHA 184 loan options. Please note that there is a period of unavailability during the 3rd and 4th quarters of the year when the federal program is re-approved for the upcoming year, typically between late September and October. Unsure if your tribe is federally recognized? We've included a list below for your review.

Why Consider the Section 184 Loan?

The Section 184 Loan offers several benefits:

Low Down Payment: Just 2.25% for loans over $50,000 and 1.25% for loans under $50,000.

Competitive Interest Rates: Rates are based on current market levels, not on the applicant's credit score.

Personalized Underwriting: This program uses a manual, hands-on approach to assess applications, rather than relying on automated systems.

Upfront Guarantee Fee and Mortgage Insurance: A one-time 1.5% upfront guarantee fee is required at closing, which can be included in the loan. For loans with a loan-to-value ratio of 78% or more, there’s also an annual 0.25% mortgage insurance premium, payable monthly.

Protection from Predatory Lending: The program oversees fees charged by approved lenders to protect Native borrowers. Note: Section 184 loans are not available for Adjustable-Rate Mortgages (ARMs).

What Can the Section 184 Loan Be Used For?

The Section 184 Loan can be used to:

Buy a New or Existing Home.

Refinance an Existing Loan (for rate and term adjustments, streamlining, or cash-out refinancing).

Oklahoma Tribes

Below is a list of the Oklahoma tribes, along with the tribal benefits available for those in the Northeast Corner of Oklahoma. Please note that not all tribes have been researched at this time. If you need assistance in researching benefits specific to your tribe, feel free to reach out to us.

Oklahoma Tribes

Below is a list of the Oklahoma tribes, along with the tribal benefits available for those in the Northeast Corner of Oklahoma. Please note that not all tribes have been researched at this time. If you need assistance in researching benefits specific to your tribe, feel free to reach out to us.

A

Absentee-Shawnee Tribe of Indians

Alabama-Quassarte Tribal Town

Apache Tribe of Oklahoma

C

Cherokee Nation

Cheyenne and Arapaho Tribes

Citizen Potawatomi Nation

Comanche Nation

Caddo Nation of Oklahoma

D-I

Delaware Nation

Delaware Tribe of Indians

Eastern Shawnee Tribe of Oklahoma

Fort Sill Apache Tribe of Oklahoma

Iowa Tribe of Oklahoma

K

Kaw Nation

Kialegee Tribal Town

Kickapoo Tribe of Oklahoma

Kiowa Indian Tribe of Oklahoma

M

Miami Tribe of Oklahoma

Modoc Tribe of Oklahoma

Muscogee (Creek) Nation

O-P

Osage Tribe

Ottawa Tribe of Oklahoma

Otoe-Missouria Tribe of Indians

Pawnee Nation of Oklahoma

Peoria Tribe of Indians of Oklahoma

Ponca Tribe of Indians of Oklahoma

Q-S

Quapaw Tribe of Indians

Sac & Fox Nation

Seminole Nation of Oklahoma

Seneca-Cayuga Tribe of Oklahoma

Shawnee Tribe

T

The Chickasaw Nation

The Choctaw Nation of Oklahoma

Thlopthlocco Tribal Town

Tonkawa Tribe of Indians of Oklahoma

W

United Keetoowah Band of Cherokee Indians in Oklahoma

Wichita and Affiliated Tribes

(Wichita, Keechi, Waco and Tawakonie)

Wyandotte Nation

A

Absentee-Shawnee Tribe of Indians

Alabama-Quassarte Tribal Town

Apache Tribe of Oklahoma

C

Cherokee Nation

Cheyenne and Arapaho Tribes

Citizen Potawatomi Nation

Comanche Nation

Caddo Nation of Oklahoma

D-I

Delaware Nation

Delaware Tribe of Indians

Eastern Shawnee Tribe of Oklahoma

Fort Sill Apache Tribe of Oklahoma

Iowa Tribe of Oklahoma

K

Kaw Nation

Kialegee Tribal Town

Kickapoo Tribe of Oklahoma

Kiowa Indian Tribe of Oklahoma

M

Miami Tribe of Oklahoma

Modoc Tribe of Oklahoma

Muscogee (Creek) Nation

O-P

Osage Tribe

Ottawa Tribe of Oklahoma

Otoe-Missouria Tribe of Indians

Pawnee Nation of Oklahoma

Peoria Tribe of Indians of Oklahoma

Ponca Tribe of Indians of Oklahoma

Q-S

Quapaw Tribe of Indians

Sac & Fox Nation

Seminole Nation of Oklahoma

Seneca-Cayuga Tribe of Oklahoma

Shawnee Tribe

T

The Chickasaw Nation

The Choctaw Nation of Oklahoma

Thlopthlocco Tribal Town

Tonkawa Tribe of Indians of Oklahoma

W

United Keetoowah Band of Cherokee Indians in Oklahoma

Wichita and Affiliated Tribes

(Wichita, Keechi, Waco and Tawakonie)

Wyandotte Nation

NE Oklahoma Tribes

The Shawnee Tribe

The Tribe will provide financial assistance up to $7,500 assistance in down payment closing costs to relieve a portion of the financial burden to purchase a new home. Applicant income, location, or dual citizenship status will not be used to determine applicant eligibility.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link:

Housing, Utilities & Safe in Wiikiwa Programs – The Shawnee Tribe

The Modoc Tribe

The Modoc Tribe – The tribe offers a low income housing program which is followed by this link:

The Wyandotte Tribe

The Wyandotte Tribe – “The tribe offers Down payment Assistance available for first time home buyers. Homes must be within a 50 mile radius of Wyandotte Nation.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link:

Wyandotte Nation Housing Down Payment Assistance and Closing Cost Assistance Program Application

The Quapaw Tribe

The tribe offers an Elder Housing Program followed by this link: Elder Housing Program

The Peoria Tribe

The tribe offers a Down Payment and Closing Cost Assistance Grant (DPA) for eligible Native Americans families to secure a loan from a reputable mortgage company for purchasing an approved property as their primary residence. The jurisdictional area must be a 75 mile radius of Miami.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link: The Peoria Housing Authority Down Payment and Closing Cost Assistance Program

The Ottawa Tribe

The tribe offers a Down Payment and Closing Cost Assistance Grant (DPA) for eligible Native Americans families to secure a loan from a reputable mortgage company for purchasing an approved property as their primary residence. The jurisdictional area must be a 75 mile radius of Miami.

The Miami Tribe

The tribe’s website is still under construction. For more info about housing grants, contact their office at (918) 541-1300.

The Seneca Cayuga Tribe

Down payment for Home Ownership is funds provided on behalf of an eligible applicant for closing costs/down payment. The applicant must secure non-predatory financing for the balance of the dwelling. Seneca-Cayuga Nation tribal members will receive preference and must live within a 50 mile radius of the main tribal headquarters in Grove Oklahoma. The dwelling unit must be acquired or built in either Ottawa or Delaware counties of Oklahoma.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link. http://sctribe.com/service/housing/ When you click it, click download under NAHASDA Down Payment Assistance Program.

The Cherokee Tribe

The tribe offers a New Construction Homeownership Program. It is a lease to own program created to provide a path to homeownership for eligible Cherokee citizens. All applicants must own the land or have access to land that can be donated to the Housing Authority of the Cherokee Nation for the purpose of home construction. New Construction Homeownership Program lease payments will be based on the total development amount of the home, not to exceed market rate, and the lease term is 30 years. You can find more information as well as eligibility, guidelines, and qualifications followed by this link. https://www.hacn.org/new-home-Construction

The Mortgage Assistance Program (MAP) helps eligible Cherokee Nation citizens become homeowners by providing up to $20,000 in down payment assistance and individualized credit coaching to assist families with building or repairing credit and reaching personal financial goals. The home purchased or constructed must be located within the Cherokee Nation reservation. For more information, click the following link.

HACN | Mortgage Assistance Program

The Osage Tribe

The tribe offers Down Payment Assistance to eligible Native Americans living within the state of Oklahoma. The program is to assist first time homebuyers to find affordable, quality housing. The amount of assistance cannot exceed $5,500. Osage preference applies. You can find more information as well as eligibility, guidelines, and qualifications followed by this link. Scroll down to “Down Payment Assistance” on the following link. https://www.osagenation-nsn.gov/services/housing

The Muscogee Creek Tribe

The tribe offers a Mortgage Down Payment and Closing Costs Program to help Native American families become first-time home owners. The programs help eligible families meet this problem by helping with grant assistance for down payment and closing costs. You must live within the state of Oklahoma. You can find more information followed by this link. https://www.mcnhousing.com/mortgage-down-payment.html

NE Oklahoma Tribes

The Shawnee Tribe

The Tribe will provide financial assistance up to $7,500 assistance in down payment closing costs to relieve a portion of the financial burden to purchase a new home. Applicant income, location, or dual citizenship status will not be used to determine applicant eligibility.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link:

Housing, Utilities & Safe in Wiikiwa Programs – The Shawnee Tribe

The Modoc Tribe

The Modoc Tribe – The tribe offers a low income housing program which is followed by this link:

The Wyandotte Tribe

The Wyandotte Tribe – “The tribe offers Down payment Assistance available for first time home buyers. Homes must be within a 50 mile radius of Wyandotte Nation.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link:

Wyandotte Nation Housing Down Payment Assistance and Closing Cost Assistance Program Application

The Quapaw Tribe

The tribe offers an Elder Housing Program followed by this link: Elder Housing Program

The Peoria Tribe

The tribe offers a Down Payment and Closing Cost Assistance Grant (DPA) for eligible Native Americans families to secure a loan from a reputable mortgage company for purchasing an approved property as their primary residence. The jurisdictional area must be a 75 mile radius of Miami.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link: The Peoria Housing Authority Down Payment and Closing Cost Assistance Program

The Ottawa Tribe

The tribe offers a Down Payment and Closing Cost Assistance Grant (DPA) for eligible Native Americans families to secure a loan from a reputable mortgage company for purchasing an approved property as their primary residence. The jurisdictional area must be a 75 mile radius of Miami. You can find more information as well as eligibility, guidelines, and qualifications followed by this link: NO LINK YET. FOR CONFIRMATION

The Miami Tribe

The tribe’s website is still under construction. For more info about housing grants, contact their office at (918) 541-1300.

The Seneca Cayuga Tribe

Down payment for Home Ownership is funds provided on behalf of an eligible applicant for closing costs/down payment. The applicant must secure non-predatory financing for the balance of the dwelling. Seneca-Cayuga Nation tribal members will receive preference and must live within a 50 mile radius of the main tribal headquarters in Grove Oklahoma. The dwelling unit must be acquired or built in either Ottawa or Delaware counties of Oklahoma.” You can find more information as well as eligibility, guidelines, and qualifications followed by this link. http://sctribe.com/service/housing/ When you click it, click download under NAHASDA Down Payment Assistance Program.

The Cherokee Tribe

The tribe offers a New Construction Homeownership Program. It is a lease to own program created to provide a path to homeownership for eligible Cherokee citizens. All applicants must own the land or have access to land that can be donated to the Housing Authority of the Cherokee Nation for the purpose of home construction. New Construction Homeownership Program lease payments will be based on the total development amount of the home, not to exceed market rate, and the lease term is 30 years. You can find more information as well as eligibility, guidelines, and qualifications followed by this link. https://www.hacn.org/new-home-Construction

The Mortgage Assistance Program (MAP) helps eligible Cherokee Nation citizens become homeowners by providing up to $20,000 in down payment assistance and individualized credit coaching to assist families with building or repairing credit and reaching personal financial goals. The home purchased or constructed must be located within the Cherokee Nation reservation. For more information, click the following link.

HACN | Mortgage Assistance Program

The Osage Tribe

The tribe offers Down Payment Assistance to eligible Native Americans living within the state of Oklahoma. The program is to assist first time homebuyers to find affordable, quality housing. The amount of assistance cannot exceed $5,500. Osage preference applies. You can find more information as well as eligibility, guidelines, and qualifications followed by this link. Scroll down to “Down Payment Assistance” on the following link. https://www.osagenation-nsn.gov/services/housing

The Muscogee Creek Tribe

The tribe offers a Mortgage Down Payment and Closing Costs Program to help Native American families become first-time home owners. The programs help eligible families meet this problem by helping with grant assistance for down payment and closing costs. You must live within the state of Oklahoma. You can find more information followed by this link. https://www.mcnhousing.com/mortgage-down-payment.html

Office:

1601 S Eucalyptus Ave Ste 200, Broken Arrow, OK

Call

(918) 373-9544

Email:

Site:

okhomesandlifestyle.com

©2024 Copyright. All rights reserved.

1601 S Eucalyptus Ave Ste 200, Broken Arrow, OK

Call

(918) 373-9544

Email:

Site:

okhomesandlifestyle.com